Contact Us

Little House Capital

35 Braintree Hill Park

Suite 100

Braintree, MA 02184

As of 03/31/2025

| Sector | Rep. Account | Benchmark |

|---|---|---|

| Communication Services | 12.1% | 11.3% |

| Consumer Discretionary | 9.2% | 12.8% |

| Consumer Staples | 4.4% | 5.0% |

| Energy | 3.1% | 1.9% |

| Financials | 11.9% | 10.8% |

| Health Care | 8.8% | 9.1% |

| Industrials | 7.0% | 6.6% |

| Information Technology | 35.5% | 38.3% |

| Materials | 1.0% | 1.3% |

| Real Estate | 1.4% | 1.4% |

| Utilities | 2.3% | 1.4% |

| Security | Weighting |

|---|---|

| Apple Inc | 8.7% |

| Microsoft Corp | 8.3% |

| NVIDIA Corp | 8.2% |

| Amazon.com Inc | 6.5% |

| Alphabet Inc | 5.9% |

| Meta Platforms Inc | 4.7% |

| Berkshire Hathaway Inc | 4.3% |

| Cash/Money Market | 3.3% |

| Walmart Inc | 2.9% |

| Mastercard Inc | 2.7% |

| Characteristics | Portfolio | Benchmark |

|---|---|---|

| P/E – Forward 12M | 26.7x | 22.3x |

| Yield % | 0.92 | 1.15 |

| Avg. Market Cap ($B) | $1,200 | $1,100 |

| Beta | 0.96 | 1.00 |

| Standard Dev. | 18.1% | 18.4% |

As of 06/30/2024

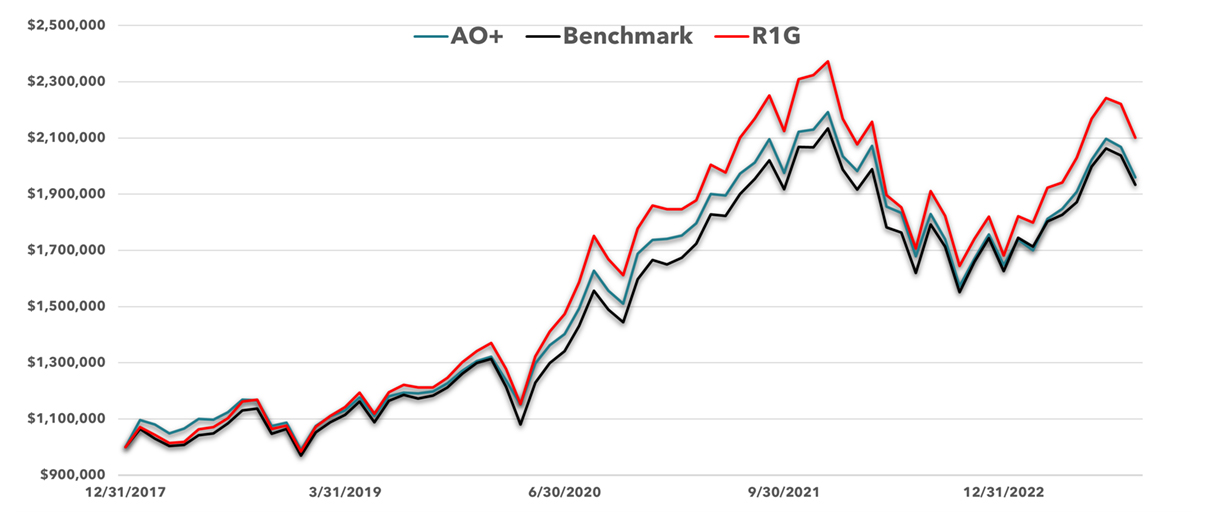

| Returns | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|

| Absolute Opportunity+ (Gross) | -0.4% | 33.0% | 34.0% | 27.5% | -25.0% | 19.8% |

| Absolute Opportunity+ (Net) | -1.4% | 32.0% | 33.0% | 26.5% | -26.0% | 19.1% |

| R1000G SPX 50/50 | -3.4% | 33.9% | 28.4% | 28.1% | -23.6% | 19.0% |

| S&P 500 | -4.4% | 31.5% | 18.4% | 28.7% | -18.1% | 13.1% |

Investment products and strategies are not guaranteed by Little House Capital LLC, are not insured by the FDIC or by any other government agency and may lose value. The information throughout this presentation is for illustrative purposes and is subject to change at any time. Holdings and sector weightings are subject to change and should not be considered investment advice or a recommendation to buy or sell a particular security. Actual holdings may vary by client. This information is supplemental to the GIPS Report. This managed account strategy involves risk, may not be profitable, may not achieve its objective, and may not be suitable or appropriate for all investors. Investors should consider the investment objectives, risks, and fees of this strategy carefully with their financial professional before investing. For legal and tax matters, legal and tax advisors should be consulted. All material is believed to be reliable, but accuracy is not guaranteed. This is not a warranty for liability on decisions based on such information. The S&P 500 and Russell 1000 Growth are designed to be leading indicators of U.S. Equities and is meant to reflect the risk/return characteristics of the large cap universe. This is not a solicitation for any order to buy or sell securities. Copyright by Little House Capital.