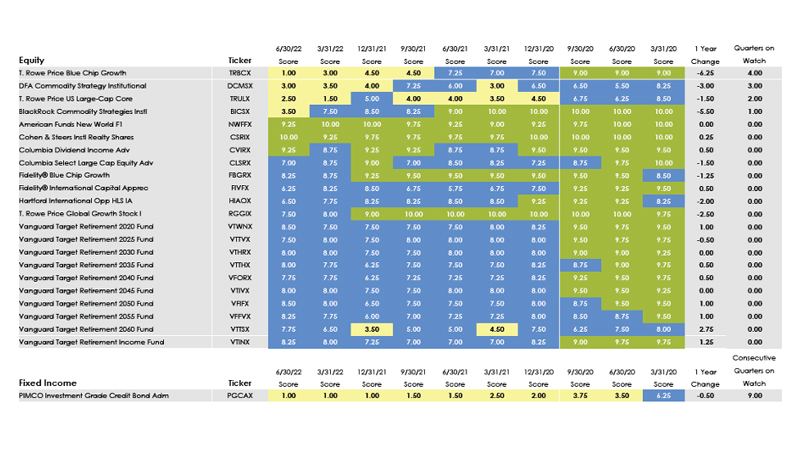

Through carefully selected investment options, on-going participant education and guidance, and thoughtful advice to plan sponsors, we look to improve outcomes for both plan participants and plan sponsors while ensuring reasonable cost.

35 Braintree Hill Park

Suite #100

Braintree, MA 02184