35 Braintree Hill Park

Suite #100

Braintree, MA 02184

Portfolio

Holdings

For Accounts with assets over $500K you would expect to have the following holdings:

- 25-50 Individual Bonds

- 3-10 Passive and Active ETFs or Mutual Funds to supplement in-house Fixed Income research

- Cash

Facts

| Inception Date | 12-31-17 |

| Benchmark | 45% Corporates 45% Barclays Aggregate 10% Municipals |

| Total Holdings Range | 38-60 |

| Top 10 Holdings % | 50-60% |

| Initial Position Size | 5-10% |

Risk Profiles

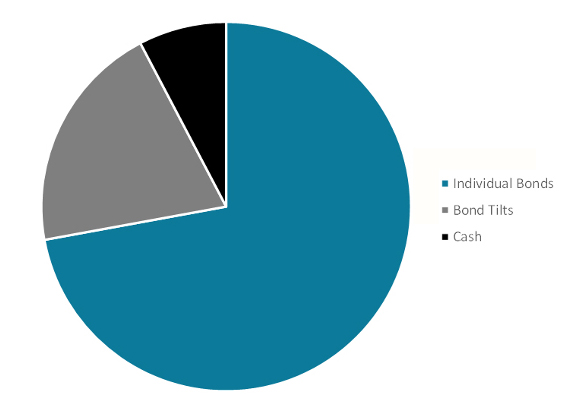

Strategic Weightings

| Asset Class | Weight | ||||||

|---|---|---|---|---|---|---|---|

| Individual Bonds | 72% | ||||||

|

|||||||

| Bond Tilts | 24% | ||||||

| Cash | 4% | ||||||

Contact Us for Detailed Performance Report

Disclosure – Investment products and strategies are not guaranteed by Little House Capital LLC, are not insured by the FDIC or by any other government agency and may lose value. The performance quoted represents past performance and does not guarantee future results. Performance is net-of-fees based on a standard fee of 1.0%/yr. Holdings and allocation may not reflect our current investment views and should not be used as the basis for an investment decision. Determining the suitability of this product will depend on feedback and risk tolerance of individual clients. For legal and tax matters, legal and tax advisors should be consulted. All material is believed to be reliable, but accuracy is not guaranteed. This is not a warranty for liability on decisions based on such information. This is not a solicitation for any order to buy or sell securities and is for discussion purposes only. Performance, risk/reward characteristics, and charts provided by Bloomberg.

Robert Stimson - Portfolio Manager -

Robert Stimson - Portfolio Manager -  James Moise - Analyst -

James Moise - Analyst -  David Mullen - Analyst -

David Mullen - Analyst -  Hampton Boyd - Investment Associate -

Hampton Boyd - Investment Associate -