35 Braintree Hill Park

Suite #100

Braintree, MA 02184

Little House Capital, LLC

71 Elm Street

Worcester, MA 0160915 Constitution Drive

Suite 1A

Bedford, NH 03110

For Accounts with assets over $500K you would expect to have the following holdings:

| Inception Date | 12-31-17 |

| Equity Benchmark | MSCI World Index |

| Bond Benchmark | 45% Corporates 45% Barclays Aggregate 10% Municipals |

| Total Holdings Range | 63-90 |

| Top 10 Holdings % | 25-40% |

| Initial Position Size | 0-5% |

Depending on a client’s investment objectives and attitudes toward risk, this strategy can be applied across a range of risk profiles to ensure the strategy helps a client reach his or her goals. Click to learn more about Risk Tolerance.

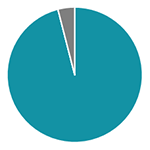

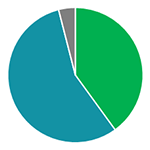

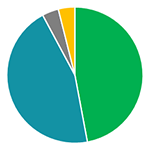

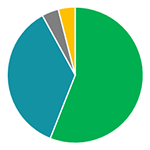

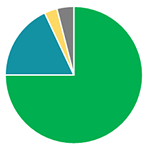

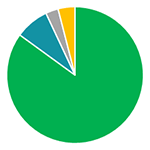

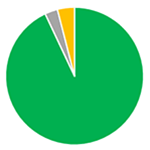

| Risk Profiles | Most Conservative | Conservative | Moderate | Balanced | Growth w/Income | Growth | Aggressive-Growth | Most-Aggressive | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity | 0% | 20% | 40% | 46% | 56% | 75% | 85% | 93% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Income | 96% | 76% | 56% | 46% | 36% | 18% | 8% | 0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alternatives | 0% | 0% | 0% | 4% | 4% | 3% | 3% | 3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash | 4% | 4% | 4% | 4% | 4% | 4% | 4% | 4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||