Contact Us

Little House Capital

35 Braintree Hill Park

Suite 100

Braintree, MA 02184

As of 03/31/2025

| Sector | Rep. Account | Benchmark |

|---|---|---|

| Communication Services | 6.8% | 6.9% |

| Consumer Discretionary | 6.7% | 8.0% |

| Consumer Staples | 8.2% | 7.6% |

| Energy | 7.2% | 5.0% |

| Financials | 18.4% | 19.0% |

| Health Care | 12.0% | 12.6% |

| Industrials | 10.3% | 11.3% |

| Information Technology. | 18.9% | 18.8% |

| Materials | 1.1% | 3.1% |

| Real Estate | 2.0% | 3.6% |

| Utilities | 4.4% | 3.9% |

| Security | Weighting |

|---|---|

| JPMorgan Chase & Co | 6.1% |

| Microsoft Corp | 4.5% |

| Visa Inc | 4.0% |

| Walmart Inc | 4.0% |

| Cash/Money Market | 3.9% |

| Apple Inc | 3.7% |

| Williams Cos Inc/The | 3.4% |

| Verizon Communications Inc | 3.1% |

| Johnson & Johnson | 2.9% |

| Chevron Corp | 2.5% |

| Characteristics | Portfolio | Benchmark |

|---|---|---|

| P/E – Forward 12M | 19.8x | 18.3x |

| Yield % | 2.33 | 2.00 |

| Avg. Market Cap ($B) | $550 | $631 |

| Beta | 0.86 | 1.00 |

| Standard Dev. | 14.9% | 16.5% |

As of 09/30/2023

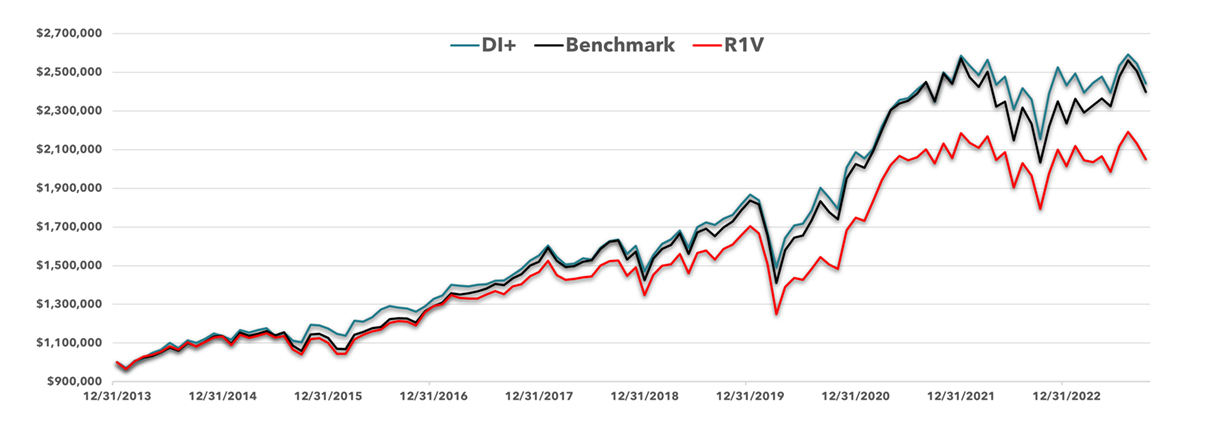

| Returns | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|

| Dividend Income+ (Gross) | 4.7% | 13.8% | 17.7% | -4.4% | 28.0% | 12.9% | 24.0% | -5.5% | 0.6% |

| Dividend Income+ (Net) | 3.7% | 12.8% | 16.7% | -5.4% | 27.0% | 11.9% | 23.0% | -6.5% | -0.2% |

| R1000V SPX 50/50 | -1.2% | 14.6% | 16.7% | -7.0% | 29.0% | 10.6% | 26.9% | -12.8% | 7.4% |

| Russell 1000 Value | -3.8% | 17.3% | 12.7% | -8.8% | 26.5% | 2.8% | 25.1% | -7.6% | 1.8% |

Investment products and strategies are not guaranteed by Little House Capital LLC, are not insured by the FDIC or by any other government agency and may lose value. The information throughout this presentation is for illustrative purposes and is subject to change at any time. Holdings and sector weightings are subject to change and should not be considered investment advice or a recommendation to buy or sell a particular security. Actual holdings may vary by client. This information is supplemental to the GIPS Report. Performance returns of less than one year are not annualized. This managed account strategy involves risk, may not be profitable, may not achieve its objective, and may not be suitable or appropriate for all investors. Investors should consider the investment objectives, risks, and fees of this strategy carefully with their financial professional before investing. For legal and tax matters, legal and tax advisors should be consulted. All material is believed to be reliable, but accuracy is not guaranteed. This is not a warranty for liability on decisions based on such information. The S&P 500 and Russell 1000 Value are designed to be leading indicators of U.S. Equities and is meant to reflect the risk/return characteristics of the large cap universe. This is not a solicitation for any order to buy or sell securities. Copyright by Little House Capital.