When Sophistication and Simplicity Merge

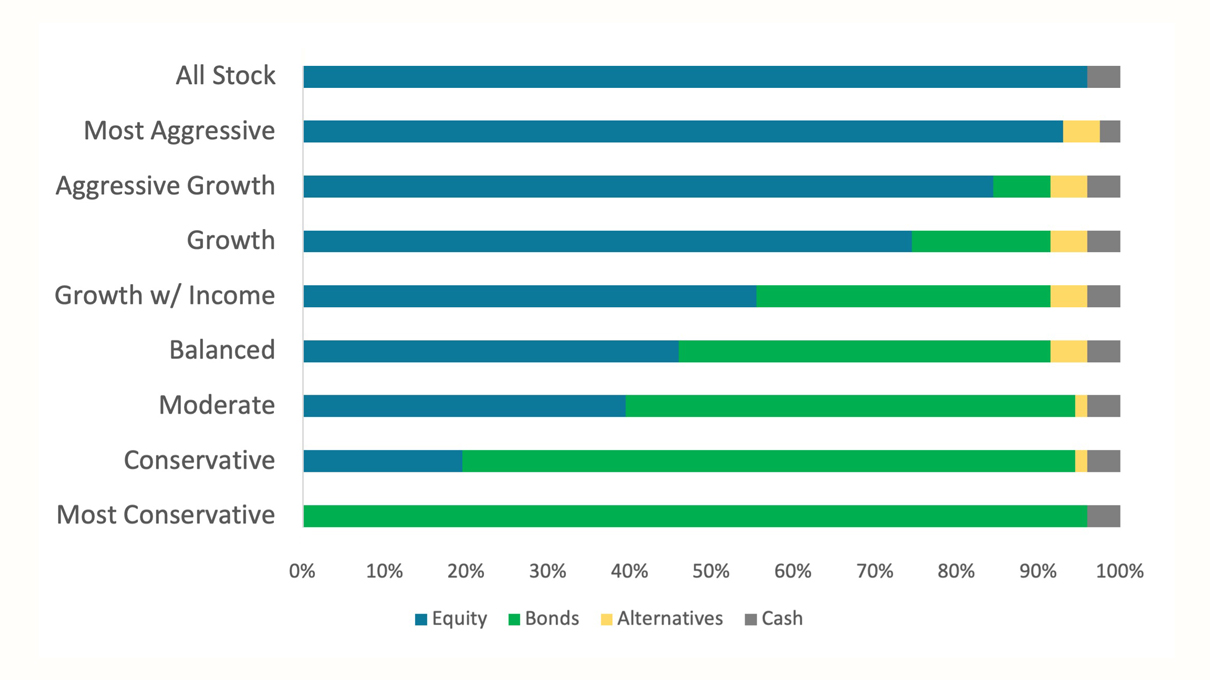

Our investment solutions offer each client access to our proprietary strategies and products supported by our in-house investment research team. We believe sophisticated real-time investment management systems, trading tools, and formal processes are needed to find and exploit global market dislocation. As a Little House client, you always have our best thinking with the assurance that the appropriate research elements are incorporated into your account(s). Performance outcomes are then compared against your specific benchmark(s) to align risk with reward for the desired outcome you should expect. At Little House we aim to turn sophistication into simplicity to achieve your long-term investment goals.

35 Braintree Hill Park

Suite #100

Braintree, MA 02184